Think of your brand as a tree. For years, leaders focused only on the fruit—the revenue, the market share, the tangible financial outcomes. But the fruit is a lagging indicator. The real source of sustainable growth lies unseen, in the root system. That system is your brand equity: the deep, resilient network of customer trust, loyalty, and positive perception. A healthy root system guarantees a future harvest. This is the essential difference in the brand value vs brand equity discussion. Value is the fruit you harvest today; equity is the health of the tree that produces it tomorrow. We’ll show you how to nurture the roots to ensure the entire system thrives.

In a market shaped by rise of AI, shrinking attention, and constant disruption, brands are being re-evaluated as operating systems for growth – not just logos or campaigns. Yet many leadership teams still blur critical distinctions between brand equity and brand value. That ambiguity is costly. Without clarity, investments drift, pricing power erodes, and competitors rewrite categories. At Vivaldi, we help leaders align the perceptions that drive demand with the financial metrics that drive performance, so your brand becomes a hard-working, compounding asset.

What is a Brand? A Foundational View

The old boardroom definition of a brand is obsolete. For decades, leaders treated brands as static assets—a logo, a color palette, a tagline—to be managed and protected. This view is a liability in a world where customers are scrolling, streaming, and searching across fragmented ecosystems. A brand is no longer a fixed identity you broadcast; it is a living, breathing system of meaning that customers co-create with you every single day. It’s the sum of every interaction, every touchpoint, and every expectation met or missed. In this fluid environment, the brand acts as a powerful operating system for growth, shaping perceptions and guiding decisions long before a customer ever considers a purchase.

Thinking of a brand as a simple marketing tool is like using a supercomputer to check email. It fundamentally misunderstands the asset’s power. A modern brand strategy recognizes that your brand is the central organizing principle for your entire business. It informs product innovation, customer experience design, and even your talent acquisition strategy. It’s the connective tissue that aligns what you promise with what you deliver, creating a coherent and compelling experience that builds trust and loyalty. When your brand is the core of your strategy, it becomes a resilient force that drives both cultural relevance and commercial performance, turning perception into profit.

More Than a Logo: A Brand is a Promise

At its core, a brand is a promise—an implicit contract with your customers about the value and experience they can expect. This promise is more than a name or logo; it’s a complex blend of feelings and beliefs that exist in the consumer’s mind. As research from QuestionPro notes, a brand is an experience that shapes what customers anticipate from every interaction. This emotional connection is the foundation of brand strength. It’s not about what you sell, but how you make your audience feel, turning passive consumers into active advocates.

This promise is also a powerful financial lever. When customers trust you, they are more willing to pay a premium, stay loyal, and forgive occasional missteps. The perception of your brand directly impacts its ability to generate revenue. As experts at The Drum emphasize, a strong brand is built on the customer’s view, and that positive perception is precisely what helps a company make more money. By treating the brand as a strategic asset—not just a creative exercise—leadership teams build a durable competitive advantage that delivers economic value and secures long-term growth.

Why The Distinction Matters Now

Executives tell Vivaldi they feel pressure from all sides: rising CAC, retailer margin demands, and volatile forecasts. In this context, understanding brand equity vs brand value is not an academic exercise it’s a survival skill. Equity lives in minds and markets; value lives in models and multiples. If you confuse them, you will either over-invest in awareness that doesn’t move revenue or under-invest in the experiences that create durable preference. In short: mastering equity and brand value protects profit margins, accelerates business growth, and safeguards your competitive edge.

The Evolution from Product to Brand as a Strategic Asset

The old model is broken. For years, businesses treated a brand as the final layer—the logo, the packaging, the advertising campaign. It was the wrapper on the product. Today, the brand is the central organizing principle for growth. It’s the sum of every interaction, perception, and promise a customer experiences. This shift reframes brand equity not as a marketing metric, but as a leading indicator of business health. It’s the measure of what people think and feel about you—their loyalty, their trust, their willingness to advocate. When that equity is strong, it becomes a powerful economic engine, converting positive sentiment into predictable revenue and market leadership.

Informing Smarter Business Decisions: M&A, Pricing, and Investment

This distinction between equity and value has profound implications in the boardroom. During a merger or acquisition, the brand value on a balance sheet is a lagging indicator. The real asset being acquired is the brand equity—the strength of the customer relationship. An acquirer must ask: Is this loyalty transferable? Is the brand’s reputation resilient? Understanding this helps companies avoid critical miscalculations when pricing a deal. Similarly, strong equity grants pricing power. It’s the reason customers pay a premium for one brand over another, even when the products are functionally identical. It’s the difference between competing on price and competing on preference, a far more sustainable position for long-term profitability.

Defining Brand Equity In Practice

Brand equity refers to the intangible strength of a brand as perceived by people – your target audience, employees, partners, and even investors. Vivaldi frames brand equity as the extra “pull” your brand exerts on purchase decisions beyond product function and price. It is built through brand awareness, meaningful brand associations, perceived quality, and brand loyalty. When customers perceive less risk and higher relevance, brand equity compounds.

- Brand equity vs brand value: equity exists in consumer perceptions; value is expressed in financial worth.

- Equity vs brand value conversations should start with customer perception and end with clear financial metrics.

- When both brand equity and discipline in monetization are present, brands outperform peers.

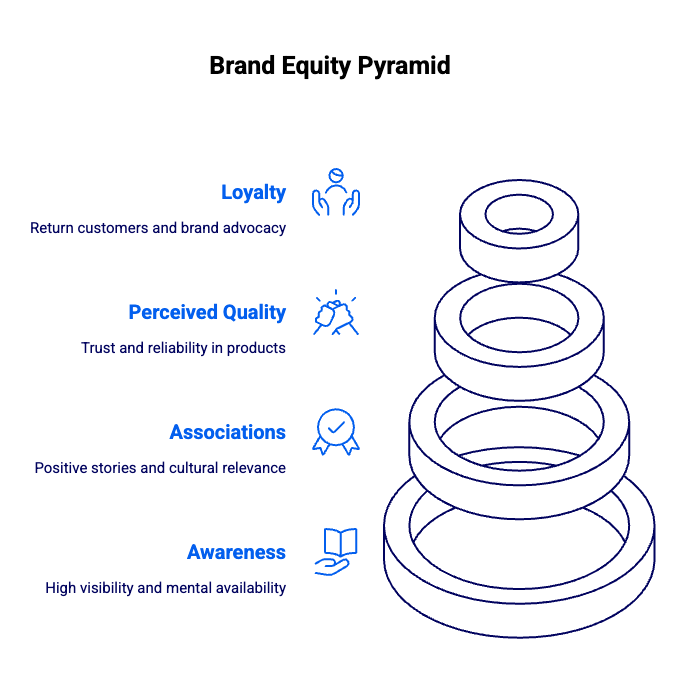

What Makes Up Brand Equity: Awareness, Associations, Perceived Quality, Loyalty

The building blocks of brand equity are well-known, but Vivaldi brings new rigor to measuring brand equity across these levers:

- Awareness and brand recognition: high brand awareness creates mental availability and brand visibility at the moment of truth. Vivaldi integrates share-of-search with social signals to map salience.

- Brand associations: positive associations, unique stories, and cultural relevance drive preference. A single positive brand association can propel premium pricing power.

- Perceived quality: customers associate quality products with trust and reliability. Perceived quality strengthens willingness to try new offers and retain customers through uncertainty.

- Brand loyalty and customer loyalty: loyal customers return, advocate, and resist switching especially when confronted by price promotions. Vivaldi tracks loyalty in cohorts to reveal where brand’s equity is compounding or leaking.

How Brand Equity Creates Customer Loyalty And Profit Margins

When Vivaldi models brand equity vs brand value interactions, a pattern emerges: strong brand equity reduces price elasticity, improves conversion, and compresses payback periods. That creates a flywheel:

- Customers feel clarity about what the brand stands for and expect quality products.

- Customer experience repeatedly meets or exceeds customer’s perception.

- Customer loyalty deepens. Loyal customers generate more lifetime value.

- The company earns the right to charge premium prices with stable profit margins.

This is how high brand equity translates into healthy unit economics, and ultimately into brand value recognized by markets.

Immediate Benefits of Strong Equity: Reduced Costs and Increased Leverage

Strong brand equity is not a long-term, abstract ambition; it is an immediate operational advantage that drives down costs and creates strategic leverage. It directly attacks customer acquisition costs by creating organic pull, reducing reliance on expensive paid media. More importantly, it insulates your business from the gravitational force of price wars. As our work consistently shows, strong equity reduces price elasticity, giving you the power to maintain premium pricing and protect profit margins even in a downturn. This financial resilience translates into powerful leverage across your entire ecosystem—with retailers who prioritize your products, with top talent eager to join your mission, and with loyal customers who become your most effective marketing channel. Equity stops being a line item and starts being your economic engine.

Defining Brand Value And How Markets Price Brands

Brand value is the financial worth of your brand asset – how much of revenue, margin, and cash flow it explains today and in the future. Vivaldi applies valuation methods to attribute monetary value to a brand’s role in demand, pricing, and retention. Analysts look at financial metrics, brand contribution to market share, and market performance to estimate a brand’s value and potential future earnings. When perceived value is high, markets reward brands with superior multiples.

Common Methods for Calculating Brand Value

Translating brand equity into a defensible financial figure is where strategy meets the spreadsheet. There isn’t a single magic formula; instead, valuation experts use a portfolio of models to triangulate a brand’s monetary worth. Each method offers a different lens on how the brand creates economic value, moving the conversation from perception to performance. At Vivaldi, we guide leadership teams through these financial models not as an academic exercise, but as a tool for making smarter, faster decisions about where to invest for growth. The goal is to build a clear, evidence-based case for the brand as a primary driver of cash flow and enterprise value.

The Royalty Relief Method

Imagine your company didn’t own its brand. How much would you pay to license it from someone else? That’s the core question behind the Royalty Relief method. As the valuation experts at ValAdvisor note, this approach “estimates how much a company would pay to use its own brand name.” It calculates a hypothetical royalty rate based on comparable licensing agreements in the industry and applies it to future revenue projections. This method is powerful because it directly links the brand to revenue generation, providing a clear financial metric that resonates with CFOs and investors alike.

The Excess Earnings Method

Strong brands generate profits beyond what their tangible assets can explain. The Excess Earnings Method is designed to isolate and quantify that premium. It works by calculating the earnings of the business and then subtracting a charge for the other assets that contribute to those earnings—like working capital, property, and patents. What’s left is the “excess,” which is attributed to the brand. This approach effectively measures the extra profits a company makes just because of its brand, demonstrating its power to command higher prices and margins than a generic competitor.

Market-Based and Cost-Based Approaches

Two other common frameworks provide practical bookends for valuation. A market-based approach looks externally, asking what another company would pay to acquire your brand in a transaction. It relies on comparable market data from recent M&A deals. In contrast, a cost-based approach looks internally, estimating “how much it would cost to create a brand just as good as your current one from scratch,” as Qualtrics explains. While the cost approach can be less indicative of future performance, together these methods provide a pragmatic range for a brand’s financial worth.

How Brand Value Appears in Financial Reporting

For the C-suite and investors, brand value becomes most tangible when it appears on the balance sheet. While internally developed brands aren’t typically listed as assets, a brand’s value is officially recognized and recorded following a merger or acquisition. This makes it a quantifiable asset subject to the same financial scrutiny as any other part of the business. As we define it at Vivaldi, “Brand value is the financial worth of your brand asset – how much of revenue, margin, and cash flow it explains today and in the future.” This formal recognition shifts the brand from a marketing expense to a core component of enterprise value, directly influencing stock price and shareholder returns.

Strategic Uses for Brand Valuation: M&A, Licensing, and Financing

A precise brand valuation is more than a number—it’s a strategic lever. In high-stakes negotiations, it provides critical leverage. A clear understanding of brand value is essential for strategic decisions in mergers and acquisitions (M&A), ensuring you don’t overpay for an acquisition or undervalue your own asset in a sale. It also forms the basis for structuring lucrative licensing deals and franchising agreements, allowing you to monetize your brand’s equity in new markets. Furthermore, a strong brand can be used as collateral to secure financing, proving to lenders that your intangible assets have concrete financial power.

Equity And Brand Value: How They Interact Across The P&L

It’s tempting to think of equity vs brand value as separate – marketing versus finance. Vivaldi advises treating them as one system:

- Equity and brand value reinforce each other when pricing, innovation, and go-to-market align.

- Positive brand equity enables premium pricing, stabilizing profit margins, which increases financial worth.

- Weak equity forces discounting, which lowers brand value and market performance.

This is why business aiming to scale must manage brand’s equity as aggressively as they manage cash.

The Brand Value Chain: From Marketing Spend to Shareholder Value

Marketing investments are not expenses; they are capital allocated to build a financial asset. The mechanism for this conversion is the brand value chain. It begins when you invest in activities that build brand equity—the intangible strength and “extra pull” your brand has on customer decisions. Strong brand equity changes behavior. It reduces price elasticity, improves conversion rates, and shortens sales cycles. This creates a powerful flywheel effect where customers feel confident in what the brand represents, expect quality, and become more loyal. As Vivaldi’s research confirms, when both strong brand equity and discipline in monetization are present, brands consistently outperform their peers, turning perception into measurable shareholder value.

When Equity and Value Diverge: Common Scenarios

Alignment is the goal, but divergence is common. A brand can have high equity but low financial value when it’s loved by consumers but fails to translate that affection into sales or pricing power due to a flawed business model or poor distribution. Conversely, a brand can show high short-term value with low equity by relying on aggressive promotions and discounting. This approach erodes margins and trains customers to wait for sales, creating a hollow brand that lacks long-term resilience. As we often advise clients, if you confuse brand equity and brand value, you risk misallocating capital—either over-investing in awareness that doesn’t drive revenue or under-investing in the experiences that build lasting preference and financial strength.

From Strong Brand Equity To Premium Prices And Premium Pricing

Vivaldi’s data shows that high perceived value, born of strong brand equity, is the precondition for premium pricing. You can charge premium prices sustainably only when customers assign a clear difference to your offer. Premium prices reflect confidence in product quality, service, and outcomes. Without strong brand equity, premium pricing becomes a short-lived tactic. With strong brand equity, it becomes a strategic advantage baked into your category.

Measuring Brand Equity And Brand Value With Rigor

You cannot manage what you do not measure. Vivaldi builds unified dashboards so marketing and finance can measure brand inputs and outputs together. We emphasize measuring brand equity with:

- Aided and unaided awareness against the target audience.

- Perceived quality and brand trust tracking.

- Strength of brand associations mapped to choice drivers.

- Loyalty and customer behavior signals tied to retention.

On the financial side, we measure brand value with contribution models that link brand’s equity to price realization, market share, and profit margins. Measuring brand is not annual theater it is monthly governance. For deeper background, see Vivaldi’s perspective on Brand Strategy and how strategy connects to valuation.

Focus Groups, Customer Surveys, And Behavioral Data

Vivaldi integrates qualitative depth with quantitative scale. Focus groups surface emotional language and positive brand association nuances that fuel creative briefs. Focus groups also stress-test category narratives and cultural tensions. Customer surveys quantify the drivers of brand equity vs adoption barriers. Then, we connect survey responses to behavioral data repeat rate, NPS, and cohort retention, so measuring brand equity reveals what actually moves revenue. This mixed method approach improves how you measure brand signals and translate them into action.### Measuring Functional and Emotional Associations

Functional associations are the price of entry. They answer the rational question, “What does it do?” and are easily tracked with performance data and user feedback. But the real competitive moat is built on emotional associations—the answer to a much deeper question: “How does it make me feel?” This is where brands create irrational loyalty and justify premium pricing. Does your brand signify belonging, intelligence, or rebellion? We map this entire landscape, using AI to analyze language at scale and qualitative work to uncover deep human motivations. This allows us to help clients design brand experiences that satisfy the rational mind while capturing the emotional heart, turning perception into durable profit.

Building Brand Equity In The AI Era: Identity, Experience, Community

To build brand equity now, Vivaldi recommends three compounding moves:

- Clarify brand identity and brand personality: sharpen your brand’s identity as a set of promises people can recognize in seconds. Ensure the brand’s identity codes show up consistently in digital journeys.

- Orchestrate customer interactions end-to-end: align product quality, service design, and excellent customer service with what your brand stands for. Remove frictions that dampen customer perception.

- Activate community: invite user generated content to amplify brand visibility and social proof. Community adds resilience to brand’s equity during shocks.

With these moves, you boost brand equity in ways that also lift conversion and lifetime value.

Brand Associations And Brand Recognition In Crowded Markets

In cluttered categories, Vivaldi sees brand associations do the heavy lifting. When customers perceive a unique set of benefits and meanings, they choose you faster. Brand recognition built on distinctive assets – color, sonic cues, packaging – shortens time-to-trust and guards against aggressive copycats. Your brand’s reputation is the outcome of thousands of micro-moments where expectations meet reality. Strengthen these moments and your brand’s equity compounds.

Positive Brand Equity, Positive Brand Association, And Risk Management

Positive brand equity protects during crises. Vivaldi has observed that brands with positive brand equity and strong positive brand association recover demand faster after service issues. Why? Customers’ perceptions give you the benefit of the doubt when the unexpected hits. To defend brand’s equity, scenario-plan problems, practice honest communication, and prioritize make-goods that reinforce perceived value. Reputation is recoverable; trust is not.

High Brand Equity, High Perceived Value, And Financial Worth

High brand equity is not a vanity metric; it is predictive of financial success. Vivaldi’s analysis shows that categories with high brand equity leaders also show healthier profit margins and steadier cash flows. These brands enjoy high perceived value, which stabilizes revenue even in promotional cycles. Over time, that creates measurable financial worth attributed to the brand on the balance sheet. Markets notice, and reward valuable brands that sustain pricing power.

The Tangible Impact of Brand on Business Valuation and Stock Returns

The stock market doesn’t trade in feelings, but it absolutely prices them. The tangible impact of a strong brand is most visible in business valuation and stock returns, where perception becomes performance. Companies with high brand equity consistently demonstrate healthier profit margins and more predictable cash flows. This isn’t a coincidence. As our analysis shows, positive brand equity grants you pricing power, which stabilizes earnings and reduces the financial risks associated with market volatility. Investors reward this stability and predictability. When customers perceive high value in a brand, the market responds by awarding that company superior multiples. Your brand, therefore, is not just a marketing asset; it is a financial instrument that directly influences shareholder value and secures a company’s long-term financial health.

Language Clarity: Equity vs Brand Value, Equity vs Brand, And Common Misspellings

Terminology confuses teams. Vivaldi recommends standardizing language:

- Brand equity vs brand value: equity is consumer-driven; value is finance-driven.

- Equity vs brand value discussions should connect perception metrics to valuation models.

- Equity vs brand misunderstandings often lead to underfunded experience design.

A note on search behavior: people sometimes type “rand equity vs brand value” by mistake. If you see “rand equity vs brand value” in dashboards, treat it as the same intent as brand equity vs brand value. Vivaldi even tags “rand equity vs brand value” as a common misspelling in SEO hygiene.

Turning Brand’s Equity Into Business Growth And Market Share

Brand’s equity must show up in the P&L and company economic value. Vivaldi operationalizes brand’s equity into:

- Higher conversion at like-for-like spend.

- Improved retention as loyal customers face competitive offers.

- Better price realization to expand profit margins.

- Share gains in priority segments, not just broad market share increases.

When leaders link brand’s equity to specific commercial plays, the organization learns to protect and grow brand value with discipline, economic profits and financial results above their peers.

How Vivaldi Connects Brand Identity To Valuation And Premium Pricing

Brand identity is not window dressing. Vivaldi codifies identity so it can be costed and valued. We map which identity elements drive perceived quality and willingness to pay. Then we build test-and-learn sprints to validate premium pricing thresholds. This is how brand’s equity turns into monetary value. If customers assign higher utility and meaning to your offer, they will accept premium prices without friction.

The Metrics That Matter: Measuring Brand And Proving Financial Worth

Boards expect rigor. Vivaldi’s measurement stack aligns both sides of the equation:

- Measuring brand: awareness, distinctiveness, consideration, brand trust, perceived value, and brand associations.

- Measuring brand equity: strength, relevance, differentiation, and energy tied to conversion and retention metrics.

- Brand value: incremental revenue from price realization, cost-to-serve reductions from loyalty, and brand’s contribution to enterprise value.

This framework ensures equity and brand value are monitored like any strategic asset.

Practical Ways To Build Brand Equity Without Waste

Vivaldi prioritizes moves that grow brand’s equity and reduce inefficiency:

Vivaldi prioritizes moves that grow brand’s equity and reduce inefficiency:

- Tighten your demand narrative so customers perceive a unique difference in seconds.

- Concentrate media in memory-building contexts to increase brand recognition.

- Invest in quality products and service recovery that cements brand loyalty.

- Use community and user generated content to widen reach at low cost.

- Simplify journeys to improve customer experience and strengthen customer relationships.

Done right, these actions build brand equity and cascade into brand value.### Crafting a Compelling Brand Story A brand story is not marketing copy; it is the strategic architecture of perception. It provides the “why” that organizes every customer touchpoint, from product design to the checkout experience. This narrative is what generates the intangible strength Vivaldi defines as brand equity—the extra ‘pull’ your brand exerts on purchase decisions beyond function and price. A powerful story creates resonant brand associations and signals a higher perceived quality, giving customers a reason to choose you and a reason to stay. It transforms a commodity into a conviction, building a durable competitive advantage that can’t be replicated by competitors. ### Leveraging Brand Ambassadors and Strategic Sponsorships Think of brand ambassadors not as hired spokespeople, but as equity accelerators. Strategic partnerships allow you to borrow the credibility and positive associations that an individual or organization has already built with your target audience. This is more than a play for visibility; it’s a deliberate transfer of trust. By partnering with figures who embody your brand’s values, you can link your brand to positive attributes and rapidly increase brand recognition in a way that feels authentic. The right alignment makes your brand’s identity more concrete and relatable, fast-tracking the development of the positive associations that fuel brand equity. ### Building Relationships Through Consistent Communication Brand equity is a living asset, either nurtured or neglected with every interaction. Consistent, open communication is the system that keeps it healthy. Every touchpoint—from a customer service ticket to a social media reply—is an opportunity to reinforce what your brand stands for. When you actively solicit feedback and respond with transparency, you build the trust that cements brand loyalty. This isn’t about broadcasting messages; it’s about creating a dialogue that makes customers feel valued and heard. This consistency proves your brand promise is real, turning transactional customers into loyal advocates who defend and grow your brand’s value.

Research That Reveals What Customers Perceive And Why They Choose

To understand how customers perceive your brand, Vivaldi triangulates:

- Focus groups to uncover emotional language and latent needs.

- Customer surveys to quantify drivers of choice among the target audience.

- Behavioral analytics to validate what people actually do consumer behavior at scale.

This mixed-method approach ensures your team sees where brand’s equity is strong, where customers associate friction, and where investment will move the needle fastest.

Pricing Power: When To Charge Premium Prices

Premium pricing is an outcome, not a tactic. Vivaldi advises brands to charge premium prices when:

- Perceived quality is consistently high across touchpoints.

- Perceived value exceeds alternatives on functional, emotional, and social dimensions.

- Loyal customers advocate, lowering acquisition dependence.

- Your brand’s worth is clear to future customers and new customers alike.

With this discipline, premium pricing becomes a sustainable advantage embedded in your brand’s equity.

Elevating The Levers: From Customer Experience To Brand Visibility

Every interaction shapes customer’s perception. Vivaldi helps brands:

- Instrument customer experience to remove friction and add delight.

- Raise brand visibility by optimizing category entry points and distinct assets.

- Protect the brand’s reputation through proactive listening and fast response.

Small improvements repeated at scale strengthen strong brand equity and make your brand more resilient.

Translating Equity Into Value: Financial Metrics And Market Performance

CFOs want proof. Vivaldi links brand equity vs brand value through:

- Financial metrics like price realization, CAC payback, and contribution margin.

- Market performance indicators such as market share by segment and growth in profit pools.

- Forecasts tied to potential future earnings that brand’s equity unlocks.

With this clarity, leadership teams see how investments in brand’s equity convert into measurable brand value.

Avoiding The Common Pitfalls That Erode Brand’s Equity

Vivaldi often diagnoses avoidable leaks:

- Fragmented brand’s identity confuses customers and teams.

- Overextension into segments that dilute perceived value.

- Inconsistent product quality that undermines trust.

- Short-term promotions that train deal-seeking behavior and harm brand value.

When these patterns persist, both brand equity and valuation suffer.

A Quarterly Operating Rhythm For Measuring Brand Equity And Value

Vivaldi recommends a simple cadence:

- Monthly: measuring brand signals and measuring brand equity KPIs.

- Quarterly: tie equity to revenue, margin, and retention outcomes; update brand value drivers.

- Annually: recalibrate strategy and identity investments to protect and grow brand’s equity.

This rhythm ensures equity and brand value stay aligned with commercial goals.

Leadership Alignment: One Narrative Across Marketing, Product, And Finance

Misalignment shows up in the numbers. Vivaldi facilitates cross-functional workshops so marketing, product, and finance agree on:

- The role of brand equity vs brand value in key initiatives.

- How customer perception data informs roadmap decisions.

- Which profit margins and growth targets brand’s equity is expected to support.

Shared language accelerates execution and improves business success.

Category Context: Valuable Brands Win More Than Attention

In many categories, valuable brands win shelf space, talent, and negotiating leverage. Vivaldi’s research suggests that strong brand leaders maintain healthier cash flows and steadier share even when consumer preferences shift. Because customers assign meaning and trust to these brands, switching costs feel higher. Over time, that advantage shows up as durable brand value.

Bringing It Together: Equity And Brand Value As One Flywheel

The takeaway from Vivaldi’s work is simple: equity and brand value are two sides of one flywheel.

- Brand equity creates demand and resilience.

- Brand value captures monetary value from that demand.

- Reinvesting in the experiences that build brand equity expands valuation headroom.

Manage this loop deliberately and your brand’s equity will power financial success for years.

Final Thoughts: What Your Brand Stands For Needs To Be Valued Like An Asset

Your brand stands for promises you must keep consistently. Vivaldi helps leaders treat brand’s equity as a performance system tied to outcomes. When you build brand equity through clarity, consistency, and community, you create high brand equity that commands premium prices and better profit margins. When you measure brand and connect it to valuation, you transform soft perceptions into hard numbers. That is how you create a truly valuable brand with outsized brand value. Ready to connect equity and brand value to growth? Speak with Vivaldi’s experts. Contact our team to assess your brand’s worth and build a plan that drives results. What would it mean if your brand could improve pricing power by 2 points this year?

Frequently Asked Questions

My team uses “brand equity” and “brand value” interchangeably. In simple terms, what’s the most important difference I need them to understand? Think of it as the difference between your reputation and your bank account. Brand equity is your reputation—it’s what customers think and feel about you, built from every interaction they’ve ever had with your brand. Brand value is the hard number that your bank account, or more accurately, your balance sheet, reflects. You build a great reputation (equity) first, which then allows you to generate more revenue and profit (value). One is the cause, the other is the financial effect.

Is it possible for a brand to have high equity but low value? What does that look like? Absolutely, and it’s a common strategic trap. This happens when a brand is deeply loved by a core group of customers but has a flawed business model that prevents it from converting that love into profit. Imagine a cult-favorite product with terrible distribution, or a brilliant service that is consistently underpriced. The positive perception and loyalty are there (high equity), but the business fails to capture that energy financially, resulting in low brand value.

How do I make a concrete business case for investing in brand equity to my finance team? You translate brand activities into the language of the P&L. Frame investments in brand equity not as a marketing expense, but as a direct driver of financial performance. Strong equity reduces customer acquisition costs because people seek you out. It allows for premium pricing, which improves profit margins. It also increases customer lifetime value because loyal customers buy more, more often. When you connect the dots between a better customer experience and lower churn or a stronger brand story and higher price realization, you’re proving that equity is a hard-working financial asset.

Which should my business focus on first: building brand equity or increasing brand value? This isn’t an either/or question; it’s a question of sequence. You must always start with brand equity. Equity is the engine of value. Trying to generate financial value without first building a foundation of customer trust and positive perception forces you into short-term tactics like aggressive promotions and deep discounting. While that might create a temporary sales lift, it erodes your brand’s long-term worth. Focus on building a brand that people trust and prefer, and the financial value will follow as a natural outcome.

What’s one common mistake companies make that silently erodes their brand equity? The most common mistake is inconsistency. This happens when your marketing promises one thing, but your customer experience delivers another. It could be a slick ad campaign for a product that has a clunky user interface, or a brand that talks about community but has unresponsive customer service. Every time there is a gap between your promise and your delivery, you create a small fissure in customer trust. Over time, those fissures add up and quietly drain the equity you’ve worked so hard to build.

Key Takeaways

- Distinguish Between Influence and Financial Worth: Brand equity is the intangible pull your brand has in customers’ minds—their trust and loyalty. Brand value is the hard number on your balance sheet. Mastering this difference is the first step to treating your brand as a strategic financial asset.

- Use Equity as a Leading Financial Indicator: Strong brand equity isn’t a vanity metric; it’s a direct predictor of business health. It enables premium pricing, lowers customer acquisition costs, and protects margins, providing a clear business case for investing in brand-building activities.

- Create a Self-Reinforcing Growth Loop: View equity and value as an interconnected system. Investing in experiences that build customer trust (equity) directly increases your brand’s financial valuation (value). This captured value then provides the resources to reinvest in the brand, creating a cycle of compounding growth.

Related Articles

- Brand Equity vs Brand Value: Key Differences and Impact

- What Is Brand Equity? Value and Impact for Your Business

- Reinventing Brand Strategy: The Holistic Brand Model – Vivaldi Group

- Vivaldi Perspective on the Evolution of Branding: From Communications to Value Creation – Vivaldi Group

- What Is Brand Awareness? Understanding Its Importance