The alcohol industry is in the midst of a profound transformation. Once defined by tradition, distribution power, and mass advertising, the category today is shaped by cultural shifts, craft movements, premiumization, and digital disruption. Whether launching a craft gin, repositioning a heritage whiskey, or scaling a ready-to-drink (RTD) innovation, success depends on more than product quality.

Winning in this space requires building distinctive, culturally resonant brands that cut through noise, navigate strict regulations, and inspire loyalty in an increasingly fragmented marketplace. In other words, brand building in alcohol has become both more challenging, and more exciting than ever before.

What is Alcohol Branding?

Alcohol branding is the strategic process of defining, shaping, and communicating a brand’s unique identity, positioning, and experience in the minds of consumers, trade partners, and culture at large.

A strong alcohol brand lives at the intersection of:

- Product Quality & Craft – ingredients, production method, provenance.

- Emotional Resonance – the lifestyle, values, and feelings the brand embodies.

- Cultural Relevance – how the brand participates in and shapes broader trends.

- Consistent Expression – across packaging, storytelling, retail, digital, and experiential touchpoints.

A bottle of wine, mezcal or whisky is not merely a beverage it’s a symbol. It carries cultural cues about status, taste, identity, and community. That symbolic power is what alcohol branding strategically builds and amplifies.

Why Alcohol Branding is Unique

Brands in the alcohol industry operate under distinct constraints and opportunities compared to other consumer categories:

- Heavy Regulation: Advertising restrictions vary widely across geographies and channels, forcing brands to be creative in storytelling while remaining compliant.

- Cultural Symbolism: Alcohol plays a role in rituals from toasts to celebrations to quiet moments making emotional resonance central to branding.

- High Substitutability: Within categories like vodka, gin, or beer, functional differences are often minimal, so brand plays a significant role in driving preference and purchasing decisions.

- On-Trade & Off-Trade Dynamics: Bars, restaurants, and retail shelves are key brand theaters. Control over brand experience is often indirect.

- Social Responsibility Expectations: Consumers and regulators increasingly expect brands to model moderation and responsible marketing.

This unique mix makes alcohol branding both highly strategic and creatively fertile.

The Evolution of the Alcohol Industry

The past two decades have seen seismic shifts in the alcohol landscape:

- Consolidation: Global players like Diageo, Pernod Ricard, and AB InBev have grown through acquisition.

- Rise of Craft: Thousands of indie breweries, distilleries, and natural wine makers have injected authenticity and experimentation into the market.

- Premiumization: Consumers are trading up, seeking quality, craftsmanship, and story not just volume. The $100+ tequila or limited cask whiskey is no longer niche.

- Digital Disruption: E-commerce, social media, and direct-to-consumer channels have opened new branding frontiers, bypassing traditional distributors.

- Mindful Drinking: Low- and no-alcohol offerings are surging as consumers seek moderation without sacrificing taste or ritual.

These forces mean that brand strategy must evolve from traditional advertising-driven awareness plays to holistic, demand-led brand ecosystems.

Developing a Brand Identity That Stands Out

In crowded categories, identity is the strategic foundation. Strong alcohol brands articulate a distinctive, emotionally resonant identity that guides all creative and commercial decisions.

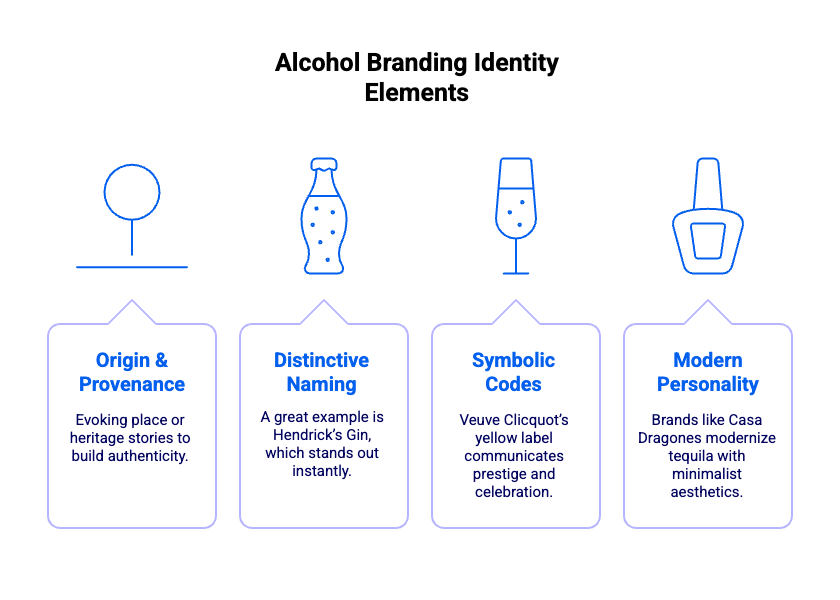

Key elements include:

- Origin & Provenance: Evoking place (e.g., Islay whiskies, Napa wines) or heritage stories to build authenticity.

- Distinctive Naming & Iconography: A great example is Hendrick’s Gin, which, with its apothecary bottle and whimsical language, stands out instantly.

- Symbolic Codes: Veuve Clicquot’s unmistakable yellow label communicates prestige and celebration before a word is read.

- Modern Personality: Brands like Casa Dragones modernize tequila with minimalist aesthetics and sleek positioning.

The best identities balance tradition and modernity honoring provenance while crafting fresh, relevant narratives for contemporary audiences.

Crafting an Alcohol Brand: From Ideation to Execution

Creating an alcohol brand requires a structured strategic process:

- Insight & Opportunity Identification

Understand cultural trends, category dynamics, and consumer behaviors. For example, RTDs have exploded among younger audiences seeking convenience without sacrificing flavor. - Brand Positioning

Define the brand’s unique value proposition and emotional territory. Is it about refined elegance, rebellious experimentation, or sustainable local sourcing? - Name & Visual Identity Development

Craft a distinctive brand name, visual language, and tone of voice that reflect the positioning and appeal to target segments. - Go-to-Market Strategy

Align distribution, pricing, and marketing tactics to create a coherent brand experience across on-premise, off-premise, and digital channels. - Execution & Activation

Launch with impact through a mix of PR, influencer collaborations, events, and digital storytelling, ensuring consistency and regulatory compliance.

Alcohol Packaging Design: More Than Just Looks

In alcohol branding, packaging is often the first and most influential brand touchpoint. A well-designed bottle or can must communicate the brand’s personality, quality, and promise at a glance. Key principles include:

- Distinctive Shape & Structure: Unique bottle silhouettes help brands stand out and become instantly recognizable. Think Crystal Head vodka, or Clase Azul tequila.

- Tactile Premium Cues: Embossing, foil stamping, and textured labels can elevate perceived value.

- Storytelling Through Design: Visual elements should narrate the brand’s origin, craft, or ethos without overwhelming.

- Functional Considerations: Packaging must also support usability for example, resealable RTD cans or lightweight shipping-friendly bottles.

Iconic examples include Absolut’s minimalist bottle, Veuve Clicquot’s bright yellow label, and craft beers that use illustration as cultural commentary.

Differentiation Through Storytelling and Authenticity

Storytelling is one of the most potent levers in alcohol branding. Consumers seek more than flavor they seek meaning. Whether it’s the history of a distillery, the ethos of a founder, or the terroir of a vineyard, stories build emotional bonds.

Authenticity is critical. Consumers, especially younger segments, are highly attuned to superficial claims. Brands that genuinely embody their narratives through sourcing, production, and community engagement win trust and loyalty.

But storytelling must be authentic and multidimensional, not just a tale told on the back label.

- Founding Narratives: The Macallan emphasizes heritage and mastery to justify its luxury positioning.

- Production Transparency: Natural wine labels lean into process and philosophy.

- Cultural Stories: Brands like Jameson build global communities through convivial Irish identity.

- Contemporary Twist: Hendrick’s blends Victorian eccentricity with modern wit, creating a memorable narrative universe.

Consumers, especially younger segments, are adept at spotting inauthenticity. Real stories, well told, create emotional stickiness and word-of-mouth momentum.

Craft Alcohol Branding: Trends, Tribes & Trust

The craft movement has upended category norms. Successful craft brands tap into niche tribes and values to build outsized influence:

- Localism & Community: Microbreweries thrive by embedding themselves in local culture.

- Transparency: Craft distillers often showcase their methods openly, building trust through honesty.

- Design Innovation: Craft beers use irreverent design to break away from category tropes.

- Tribal Engagement: Think of beer enthusiasts trading rare releases, or mezcal aficionados debating terroir nuances.

These strategies enhance differentiation and a sense of community, enabling smaller brands to punch above their weight.

Luxury and Premium Positioning in Alcohol Branding

Premium and luxury alcohol branding operates on different symbolic levers:

- Scarcity & Exclusivity: Limited casks, numbered bottles, and small batches create collectibility.

- Elevated Design: Heavy glass, elegant labels, and distinctive shapes convey sophistication.

- Heritage & Provenance: Macallan, Dom Pérignon, and Louis XIII trade on history and meticulous craft.

- Cultural Association: High-end collaborations (e.g., Hennessy x contemporary artists) link brands to broader cultural cachet.

- Experiential Prestige: Private tastings, immersive events, and luxury retail spaces extend the aura beyond the bottle.

Strategically, premiumization allows brands to expand margins, elevate perception, and deepen emotional engagement.

Digital Marketing for Alcohol Brands

Digital channels have opened new avenues for alcohol branding but require strategic adaptation:

- E-Commerce & DTC: Navigating legal frameworks while offering seamless purchase experiences.

- Social Media Storytelling: Platforms like Instagram and TikTok are crucial for lifestyle positioning.

- Content Marketing: Thoughtful editorial content, behind-the-scenes videos, and mixology tutorials deepen engagement.

- Community-Building: Digital communities can mirror on-premise brand worlds, fostering loyalty and advocacy.

The most successful brands balance compliance with creativity, using digital tools to amplify emotional connection and drive conversion.

Navigating Advertising Regulations and Compliance

Alcohol branding operates under complex, variable regulations covering placement, targeting, and content. Strategic approaches include:

- Building Compliance into Creative: So storytelling works within guardrails, not against them.

- Leveraging Owned & Earned Media: Branded experiences, social content, and influencer advocacy often offer more flexibility than paid ads.

- Regional Adaptation: Global brands must localize campaigns to fit local rules what works in Italy may not in the U.S.

Compliance is not a constraint to creativity it’s a design parameter that often sparks more innovative solutions.

The Role of Influencers in Alcohol Branding

Influencers have become powerful cultural bridges for alcohol brands, especially where traditional advertising is limited.

Strategic best practices include:

- Authentic Fit: Partnering with voices who genuinely align with the brand’s values and aesthetic.

- Creative Freedom: Allowing influencers to interpret the brand naturally, not via scripted ads.

- Long-Term Partnerships: Ambassadorships build sustained trust (e.g., Casamigos leveraged celebrity ownership authentically).

- Regulatory Diligence: Transparent disclosures and responsible messaging are essential.

When executed well, influencer collaborations extend brand narratives into cultural spaces consumers trust.

Measuring Brand Success in the Alcohol Space

Measuring alcohol branding effectiveness requires both qualitative and quantitative metrics:

- Brand Awareness & Recall through surveys or digital analytics.

- Perceived Quality & Distinctiveness via brand equity tracking.

- Sales & Market Share data to assess commercial performance.

- Engagement Metrics across digital platforms.

- Cultural Relevance Indicators (e.g., earned media, social buzz, collaborations).

Robust measurement frameworks help brands optimize strategy over time, ensuring investments translate into equity and growth.

Competitive Analysis: Learning from the Best

Successful brands offer instructive lessons:

- Aperol built a cultural phenomenon through lifestyle positioning and ritual (the Spritz)

- White Claw capitalized on the RTD trend with minimal branding and maximal lifestyle alignment

- Patrón fused craftsmanship with premium cues to redefine tequila’s image

- Heineken differentiates from other beer brands by leveraging consistent global positioning while innovating locally

Analyzing competitive moves reveals white spaces for differentiation and benchmarks for excellence.

Future-Proofing Your Alcohol Brand

The alcohol industry is not static it’s being reshaped by converging pressures on consumer behavior, regulatory sentiment, health awareness, channel dynamics, and cultural values. The disruption is not a one-time shock but an ongoing wave. One of the most striking shifts is that a smaller share of adults now report drinking at all, and those who drink are doing so less frequently. The data point to a more cautious, selective drinking population fewer drinkers overall, and more moderation among drinkers.

At the same time, younger cohorts (Gen Z and late Millennials) are drinking less than their predecessors. This is perhaps one of the more permanent structural changes. For alcohol brands, this generational shift means that product, messaging, and experience that resonated with prior cohorts may lose relevance unless reimagined.

Perhaps the most visible vector of disruption is the acceleration of no-/low-alcohol & “mindful drinking”, meaning that non- and low-alcohol products are growing faster than full-strength categories in many markets. Consumers are not merely replacing booze they are redefining what “drinking occasions” mean. Brands that treat no- / low-alcohol lines as afterthoughts risk missing a critical frontier for relevance.

The COVID-19 pandemic acted as a catalyst for new drinking patterns, some of which persist today. In certain groups (especially younger people), pandemic-era closure of bars and venues suppressed social drinking, contributing to shifts in context and frequency. This means some new behaviors (home consumption, smaller gatherings, mixing with nonalcoholic options) are now part of the default drinking repertoire.

All these disruptions mean that brands are facing intensifying scrutiny from regulators, consumers, and public health institutions. Alcoholic brands must increasingly integrate responsibility, moderation messaging, and transparency into their core marketing strategies and not merely treat them as afterthoughts.

Implications for Brand Strategy & How Brands Must Adapt

Given this complex and shifting landscape, brands that succeed will be those that strategically realign in three key ways. Below are strategic imperatives rooted in these data-driven disruptions:

Prioritize Margin, Not Just Sales: With overall consumption under pressure, the path to growth lies less in volume expansion and more in premiumization, brand equity, and value-add services. Brands need to:

- Elevate pricing architecture and brand laddering (e.g., special releases, small-batch variants)

- Use brand meaning and storytelling to command yield

- De-emphasize mass discounting and instead focus on emotional loyalty and repeat purchase

Embrace No / Low Alcohol as a Core Innovation Frontier: Rather than treating no- / low-alcohol lines as side experiments, brands should infuse them into the core portfolio strategy as full-fledged offerings rather than “lite” labels. That means:

- Designing branding, packaging, and storytelling that treat these lines as legitimate choices

- Ensuring flavor, format, and experience are not second-tier

- Using these lines to engage health-conscious and “sober-curious” consumers without alienating traditional drinkers

Get Generationally Fluent Recalibrate DNA for Younger Cohorts: Brands must know their target consumers and cannot assume younger consumers’ behaviors mirror those of older ones. Instead:

- Engage Gen Z in their language when conceptualizing alcohol advertisements using themes of wellness, diversity, and experiential culture

- Reassess packaging, rituals, and digital touchpoints (e.g., low-ABV cocktails, mocktails, hybrid formats)

- Invest in subcultures and micro-communities rather than mass outreach on social media platforms

Continuously Measure Leading Indicators of Cultural Resonance: Because the category is in flux, brands must track not just sales, but also cultural health metrics. These include:

- Social sentiment, brand mentions, influencer resonance

- Low-ABV / no-alcohol adoption metrics

- Consumer trust metrics around safety, transparency, moderation

Brands that can link these leading indicators to business metrics will have early warning systems and strategic agility.

Conclusion: The Path to Alcohol Branding Excellence

The disruption to the alcohol landscape is not superficial it’s structural. Declining participation, generational abstention, the rise of no/low-alcohol, health consciousness, regulatory pressure, and segmented growth zones are redefining what success looks like in this category.

For brands, the challenge is to evolve from legacy paradigms of volume and mass reach to a more agile, values-driven, consumer-centric approach. The opportunities lie in segments with generational relevance, meaningful storytelling, and an operational discipline that links brand health to business outcomes.

In the evolving alcohol landscape, branding is the ultimate competitive differentiator. It’s what turns similar liquids into iconic cultural symbols, what elevates a craft distillery into a movement, and what allows heritage players to reinvent for new generations.

The most successful alcohol brands blend strategy and creativity crafting identities that inspire, stories that stick, packaging that speaks, and experiences that connect. They navigate regulation with ingenuity, harness digital with purpose, and build communities that extend beyond the bottle.

At Vivaldi Group, we partner with alcohol brands to architect brand systems for growth blending deep cultural insight, brand strategy, and experience design to unlock new opportunities in a complex category.