Transforming Energy Providers: From Commodities to Ecosystem Platforms

The global energy crisis caused by the war in Ukraine has highlighted many of the systemic weaknesses of the current energy market. Consumers have become acutely aware of the instability of many providers and the need for a secure and stable supply, which has become an urgent issue for millions.

For energy providers, there is a choice to be made: to operate as the commodities they’ve promised to be – or to transform into wider-reaching platforms.

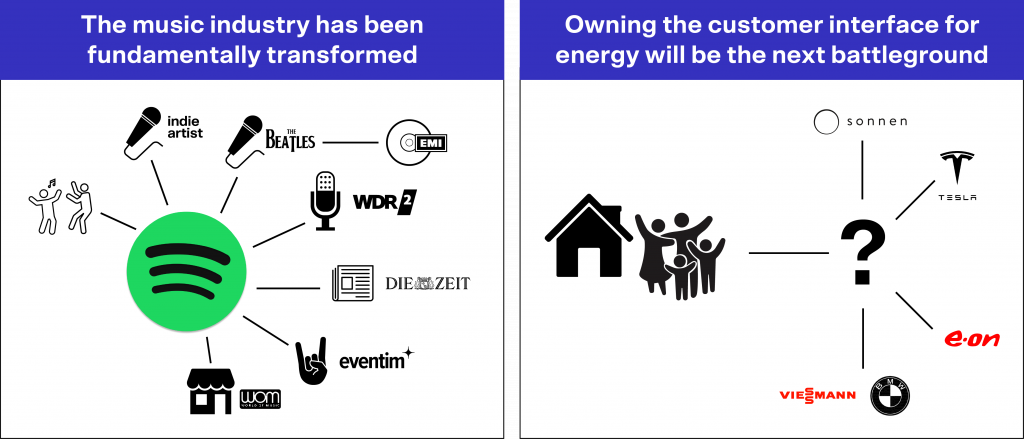

In general, retail landscapes are experiencing disruption. As retail activities in cities decline, shoppers are more attuned to digital platforms. The department stores of yesterday are now the marketplaces of Amazon, Ebay, Zalando and others. We do not frequent the good old record store anymore but rather immerse ourselves into music ecosystems that both actively and subliminally guide our behaviors and tastes. The truth is that what can become a platform, will become a platform.

The retail business of energy providers, long seen as the prototype of an oligopolistic incumbent, is bound to be disrupted next. Two key factors will be driving this change: new opportunities, and growing consumer awareness. The wider energy ecosystem is bringing these new opportunities, from electric mobility to generating power at home to smart home systems. Potent market players with renowned brands are entering the space. Additionally, the recent price hike paired with the instability of some European providers, has generated more consumer awareness about the relevance of secure and stable supply.

The ecosystem play will significantly change the market dynamics. From a 1:n relationship between an energy provider and its many customers, exchanging power or gas for a defined price, to a multitude of new solutions and hence, interactions between various market players. While the last major innovation in energy retailing was smart metering, it did not truly impact consumer behavior. Digitally monitoring consumption has been shown to provide a very limited benefit.

An ecosystem play rather becomes a battle about owning the customer interface and forming the dominant platform, which hosts the majority of interactions. Building on their long-lasting relationship and trust, incumbent providers still have the opportunity to actively frame this interaction field and guide consumer behavior and choices. However, market reality does not show a big push coming from energy providers. Rather challenger brands like Tesla have started to encroach on the space far beyond selling electric vehicles. They have bridged the last mile with photovoltaic and battery solutions, infiltrating people’s homes and home screens.

In the future, a successful energy brand will need to stand for orchestrating various aspects of people’s lives: from balancing power supply and consumption to embedding in kitchen appliances, home heating, lighting and entertainment systems. It will not be predominantly about power or gas. Instead, it will be about connecting every consumer to their ideal combination of providers and manufacturers in order to create a seamless and sustainable solution that truly contains value. Providing the operating system for people’s homes will be creating a virtuous cycle.

In this scenario, remaining simply an energy provider will eventually lead to becoming a second-tier supplier in the backrow – literally ending up as commodity. Just as streaming services like Spotify have replaced major record labels in propelling the next music success, it will take a platform brand to influence consumers and deliver value.

With the recent price hikes, consumers have also learned that energy providers, as they currently exist, only have very limited abilities to significantly impact macroeconomic aspects. Here are three things energy providers can do to evolve:

- Look at consumers’ lives from a truly outside-in perspective. Evaluate the market opportunities beyond immediate adjacencies. Just adding charging stations does not solve for the broader opportunity. Leverage data to provide efficient energy use tailored to people’s lives.

- Acknowledge the strategic relevance and role of brand. Brand often is seen as a minor driver in energy sales relative to tariff structures and sales activities. However, not a single successful platform provider has created an interaction field without a powerful brand.

- Set up a dedicated team and utilize platform thinking tools. For this, Vivaldi has specifically developed a Platform Toolkit. Framing the interaction field goes beyond classical innovation or value proposition development.

During this time of turbulence, assessing these three steps will open the possibility for energy providers to evolve beyond their current capacities, and set themselves up for future success.