What is the prognosis for healthcare as a patient? Let’s take a look at its chart: Fragmented care, rooted in disjointed data sources that do not talk to each other. Mistakes that reverberate through the system and create additional cost and risk. Disparate infrastructure that leads to a disparate approach and, as a result, focuses on the symptom versus the overall problem.

For too long, the healthcare industry’s silos and dispersed data have created numerous pain points, with problems so large that the prognosis has been poor, at best.

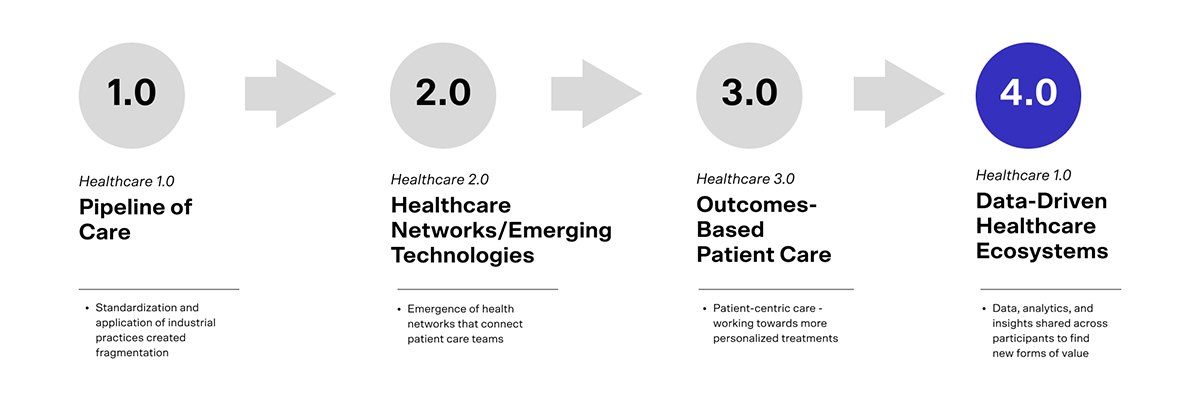

Today, however, the model may be shifting – offering many opportunities. Building on the models put forward by EY and elsewhere, the Healthcare 1.0 model was a traditional pipeline value chain, focused on creating blockbuster products and optimizing R&D productivity. Healthcare 2.0 saw the emergence of healthcare networks as consolidation intensified – a model based on Team-based-care and a cross-disciplinary approach. Emerging technologies created more opportunities for scalability and collaboration – but pain points engendered by a fragmented approach remained. Healthcare 3.0 saw a shift towards patient centricity, the emergence of value-based models due to cost pressures, and, as a result, newly diversified portfolios which served different segments of the market, leading in many cases to complex portfolios and brand architectures.

Healthcare 4.0 Takes Shape

Now the pace is accelerating toward Healthcare 4.0 – a future driven by data, collaboration, and new value creation models. In this model, the value creation method is fundamentally changed – it is no longer based on optimizing transactions (e.g. a new drug developed, marketed and sold to providers and end users). Instead, it relies on the power of data to enhance every step of the process so that the value creation model is not based on transactions anymore, but on interactions that generate data and therefore allow the creation of shared value across the ecosystem. This model is what Erich Joachimsthaler calls an Interaction Field.

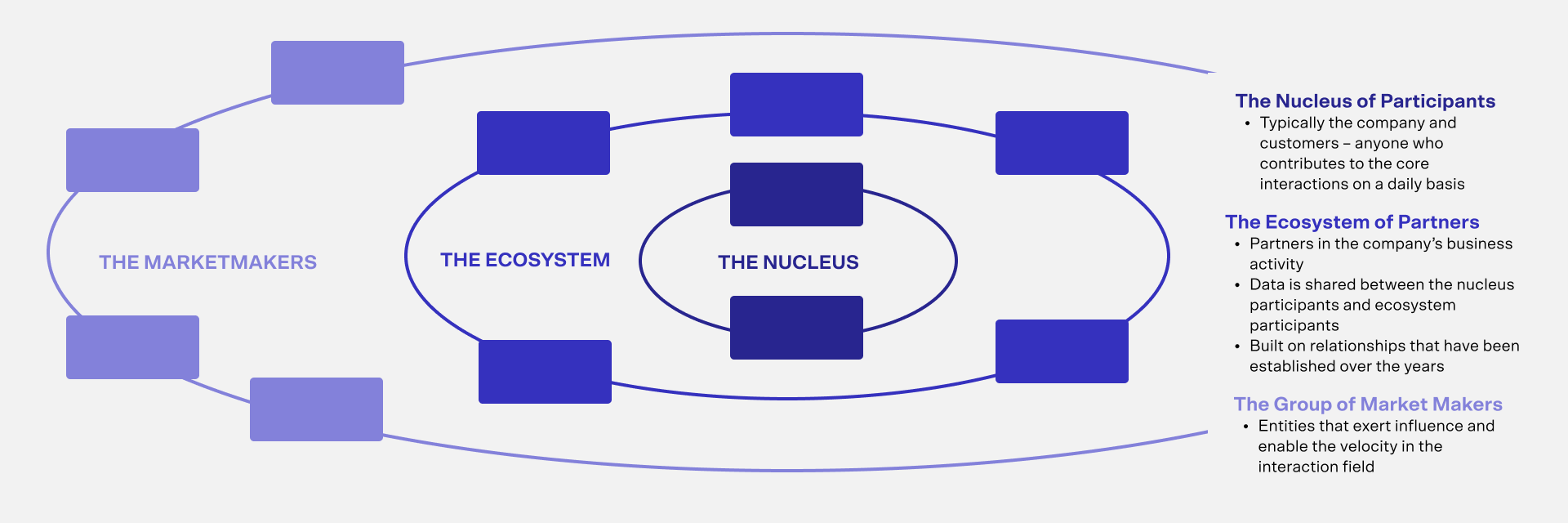

At its core, an interaction field is dependent on key interactions within the context of the healthcare industry — including, for instance, patients and healthcare providers, exchanging data in the course of these interactions. This is what we call the Nucleus of the interaction field – the first step towards creating an ecosystem.

An Ecosystem then gets built around this core, which might include health tech companies, medical device manufacturers, pharmaceutical companies, insurance companies, hospital systems, professional associations, and other groups. Beyond that, Market Makers will enable velocity in the field by exerting influence. These could include government agencies, equipment suppliers, educational institutions, and foundations or nonprofit organizations. Over time, as the field expands, it creates more shared value.

According to EY: “To create value now and in the future, life sciences companies should consider participating in data-centric platforms of care that improve individual health outcomes and reduce costs. In this environment, platforms provide a framework to create future value that is based on individualized outcomes, and is amplified by the ability to connect, combine and share data.”

Going forward, data can be used to both create universal standards of care, and to offer more personalized treatment and help deliver precision medicine – in particular in the context of blockchain and Web3 where data can be controlled not just by institutions but by patients themselves, ultimately breaking the barriers that exist to sharing it.

Harnessing the power of data produced by interactions across the ecosystem, interaction fields have the ability to address and solve new, emerging or previously unsolved problems. This is because problems of this magnitude require collaboration from players across the ecosystem, enabled by data. No one player, company, technology or system has the ability to tackle these problems on their own.

McKinsey acknowledges, “Today’s connected health technology landscape includes a wide array of apps and a dispersed set of data sources, but to fully exploit the benefits, the provision of solutions and the collection and application of data need to shift from fragmented ‘silos’ to an integrated ‘ecosystem’ of players.” (“Capturing Value From Connected Health”)

Why Healthcare is Ripe for Disruption by Interaction Fields

A siloed industry, with disconnected sources of data, leading to a disjointed patient experience, healthcare is ripe for disruption by interaction fields. In research that Vivaldi conducted among health care providers (HCPs), they shared feeling isolated, not just when faced with complex patient cases, but also in adapting to evolving requirements and changing models.

Scattered patient data, a disconnection from outcomes, and one-size-fits-all treatments — all these factors create the opportunity for a sea change.

There are several criteria that make an industry particularly well-suited for an interaction field, and healthcare presents a number of these. These criteria were examined in the BCG article “Do You Need a Business Ecosystem?”

1. A High Proportion of Information to Value Creation

Traditionally, the diagnostic model relied on unstructured data – the judgment call of an HCP. New technologies and analysis tools – such as AI-guided imaging – require the use of databases where this data can be stored and analyzed, typically dissociated from EHR because patient data needs to be de-identified. In an aggregate form, data allows the extraction of patterns – identifying how a patient condition presents itself, spotting patterns, increasingly with the help of AI – and matching treatment options in a way that allows the measuring and weighing of risk of different courses of action. In turn, pattern identification tools and AI can develop learning effects, optimizing future interactions. More data leads to smarter insights, improved pattern identification, and ultimately better outcomes for patients. As a result, an increasing proportion of value is derived from data rather than assets such as equipment and technology. This is evidenced, for instance, in the imaging market where the value of imaging equipment is increasingly enhanced by AI that guides usage and interpretation. One example among many is GE’s decision to acquire BK medical, providing AI-guided surgery – its largest acquisition in years.

2. Unpredictability

Healthcare has been undergoing rapid market evolution – and yet there is also substantial inertia across the system. The interplay between these two factors creates unpredictability, another pre-condition of the rise of interaction fields. The swift pace of technology development and adoption creates new opportunities for participants in the healthcare ecosystem, and even accommodates different paces of change.

3. Malleability

Utilizing healthcare data requires a customizable approach. Ultimately, the opportunity is in defining personalized paths based on patterns identified through aggregated patient data – something that is already being explored in genomics and will be further enabled by AI.

4. High Modularity

A high degree of modularity is an intrinsic characteristic of a fragmented industry – disparate steps of the process that create a disjointed patient experience. An interaction field has the ability to bring together different aspects of care or steps of the value chain – in a network rather than hierarchical model.

5. Intrinsic Need for Collaboration

The healthcare ecosystem requires that various participants work together – something that glaringly does not happen today. Systematic issues cannot be resolved by any one entity, but require cooperation from the likes of healthcare providers, hospitals, health tech companies, insurance companies, medical device manufacturers, and patients themselves. Beyond that, further collaboration is needed from educational institutions, equipment suppliers, foundations and nonprofits, government entities and regulatory agencies.

This model of collaboration can solve complex problems that no single entity could resolve, as well as create new market opportunities and spaces for innovation. Interaction fields are well suited for industries that have a high need for coordinated components. Enhancing collaboration can lead to improved outcomes for patients and better processes.

Types of Emerging Interaction Fields

For the various sets of interactions, different types of interaction fields are already emerging. There are four key types that are currently developing:

1. Real World Data and Health Data Companies: These companies are collaborating to revolutionize how patient data is shared and turned into insights. This data might include electronic health records and doctors’ notes. The Real World Evidence (RWE) Alliance, for instance, is a group of healthcare companies that are working to make real world data and evidence more accessible so that more informed care decisions and regulatory policies are possible. Another company, Datavant, also looks to aggregate vast amounts of patient data to develop smarter insights. Datavant brings fragmented data together across thousands of organizations to create a complete picture of patient health, but, as expected, still has some limitations on access to data.

2. Personalized and Relevant Solutions: Organizations in this type are leveraging their capabilities and insights to produce smarter patient solutions in real time at a lower cost. For example, Aetion has a platform that analyzes data from real world evidence, which can be used by providers to develop better patient solutions, and during the height of the Covid crisis, helped provide solutions directly to the FDA.

3. Foster Collaboration Amongst Care Teams: This type of interaction field can bring care teams closer together, regardless of geography. The company Owkin is aggregating data to produce insights for drug discovery and development. Through cloud capabilities compliant with patient privacy measures, they are able to work with numerous hospitals, universities, and life science companies to accelerate drug development, optimize clinical trials, and identify patient populations of interest.

4. Foster Collaboration Amongst Patients: With access to aggregated data, patients themselves can connect through online forums or other platforms to discuss conditions and treatments, provide support, and enable others to utilize health systems in a way that delivers more positive patient connections and outcomes. PatientsLikeMe is one such forum. Based on aggregated data, patients are brought together with others who have similar problems or conditions, enabling them to seek solutions in a smarter way, and allowing health systems to get more positive patient connections and outcomes as a result.

5. Sharing Insights with Patients: Analytics are as advanced as ever, and healthcare might allow for providers to have as detailed a look as ever into what may be happening to their bodies and what may be the best course of action to help treat them. Included Health is an example of a company looking to become a one stop shop in the digital health world to provide these services, as they offer personalized guidance for patients in everyday and urgent care, primary care, behavioral health, and specialty care.

While the HealthTech market has yet to shake out, large healthcare players are increasingly vying for the interaction field opportunity. Corinne Dive-Reclus, Head of Lab Insights at Roche Information Solutions has said, “With the use of digital healthcare ecosystems, we can, together and right now, innovate to change lives quickly and effectively for all.” And Pfizer’s Chief Digital and Technology Officer, Lidia Fonseca, has referred to health care as a “team sport.”

To help build health tech innovation pipelines, Novartis introduced the Novartis Biome digital innovation lab, and Merck launched Merck Digital Sciences Studio. Pfizer has been introducing AI-powered tools and apps as part of its Pfizer Digital Companion platform, and has partnered with a robotics company to deliver medications to remote areas via drone. Roche is pursuing a digital ecosystem to better unify data, with the goal of creating more personalized care. And Eli Lilly and Company has been collaborating with technology companies, including Apple, to work on solutions for health diagnoses and management.

As we move further into this Healthcare 4.0 era, the focus is on data-driven healthcare ecosystems: data, analytics, and insights shared across participants to find, and create, new forms of value. The opportunity for key healthcare players is to assess their role – participate or assume a leading role in shaping the ecosystem. Ultimately, the opportunity is larger than ecosystems within specific areas of healthcare or data aggregation; it is in what is being called the “platform of platforms” or “Interaction Field of Interaction Fields,” bringing together all different ecosystems within healthcare into one meta-ecosystem.

While it is clear that emerging Interaction Fields will pivot and evolve multiple times, the key questions will be how the future value chain shifts, which players will bring the ecosystem together, and who will be at the center. One can only hope it will ultimately be the patient.