The Vivaldi AI Model: How AI Creates Value for Businesses and Brands

The burgeoning enthusiasm for Artificial Intelligence (AI) in recent years and months has become palpably evident, especially in major conferences where it has dominated discussions. Events like the World Economic Forum in Davos and the Consumer Electronics Show (CES) in January of this year have become prominent platforms showcasing the transformative potential of AI. At these gatherings, global leaders, technologists, and innovators converged, sharing insights and forecasting the far-reaching implications of AI on businesses, brands, and society at large.

In Davos, for instance, the conversation often centered around the socio-economic impacts of AI, encompassing its potential to drive productivity, growth and innovation while also addressing concerns about job displacement, responsibility, inclusivity and ethical considerations. Similarly, at CES, AI’s influence was seen in a more practical light, with a focus on its integration into every imaginable consumer product, and how it’s reshaping industries from automotive to healthcare. The pervasiveness of AI-related topics in these conferences and others signals a recognition of its integral role in shaping our future, and the potential to revolutionize entire industries.

The AI Bubble?

The current buzz around the “AI bubble” can be contextualized by looking back at the emergence of two transformative technological eras: the internet and the mobile and social media revolution. Each of these periods marked a seismic shift in how consumers and companies interacted with technology and with each other.[1]

1. The Internet Revolution (Late 1990s — Early 2000s): This era marked the widespread adoption of the Internet, fundamentally changing the way people communicated, accessed information, conducted business and connected with brands. The introduction of web browsers in the 1990s made the Internet more user-friendly, leading to an explosion in web usage. This period saw the rise of early internet giants like Yahoo, Google, and Amazon, and was characterized by the dot-com boom — and subsequent burst of the bubble — around the turn of the millennium. The dot-com bubble was a terrible tragedy but while this era wiped out many retail investors who were gulled by Superbowl ads and while it dashed dreams of legions of startup entrepreneurs, it also laid the foundation for a globally connected world.

2. The Mobile and Social Media Era (Mid 2000s – 2010s): The launch of smartphones, epitomized by the iPhone in 2007, kicked off this era. These devices put the power of the internet in people’s pockets, leading to a dramatic shift in how people consumed media, shopped, and interacted with each other. Alongside the rise of smartphones was the explosion of social media. Platforms like Facebook, WeChat, Twitter, and later Instagram, transformed personal and public communication, creating new social dynamics and digital communities. This era also saw the app economy flourish, with millions of apps developed, affecting every aspect of daily life from navigation to health, and giving rise to gig economy companies like Uber and Airbnb.

During this period, the anticipated bubble and bust cycle did not materialize, yet it both benefited and disadvantaged businesses and consumers in various ways. It led to the emergence of a few dominant entities, often referred to by acronyms such as FANG, representing Facebook, Apple, Netflix, and Google, or FANGAM, which includes Facebook, Apple, Netflix, Google, Amazon, and Microsoft. This group evolved into the “Mag Seven,” excluding Netflix but incorporating Tesla and Nvidia. These companies leveraged their market dominance to create value, albeit in a manner that disproportionately benefited them. They did so by acquiring smaller competitors or driving them out of the market through the expansion of their own products and services. Consequently, consumers became the product, monetized through advertising, subscriptions, or app sales. In 2023 alone, the market capitalization wealth of the Mag Seven surged by an astonishing $5.1 trillion.[2]

These practices made it increasingly difficult for other companies to compete or for startups to emerge and thrive. The monopolistic behavior hindered innovation, and productivity growth decelerated significantly. Productivity growth decreased from an average of 1.7% between 1997 and 2005 to merely 0.4% since 2005.[3]

What then about the AI bubble?

The question of whether we live in an AI bubble is a moot one. Judging from the rampant use of the term AI at the World Economic Forum at Davos, and the overuse and misuse of “AI-powered” in anything that was announced at the CES tradeshow, we are already in a bubble of gigantic proportions. Some outright weird new services illustrate. What about an AI-powered app that can “translate” a baby’s cries with 95% accuracy and tells if it is hungry, in need of a diaper change, or just uncomfortable, for $10 per month? Or how about an AI-powered cat door that will lock your pet outdoors unless it drops any dead animal in its mouth? Anybody remembers sock puppets from the dot-com era?

What really matters is whether this new bubble will be as wealth destructive as the dot-com bubble or as harmful to competition as the iPhone and social media era, or whether this bubble has at last a positive effect on businesses and society.

In order to provide an answer to this question, it is important to understand how this bubble is different from the previous ones. While the two previous eras built the foundation of today’s interconnected or hyperconnected and sophisticated world, the AI era is one that analyzes that world and makes use of it.

AI appears to do at least two things. It automates and augments current business processes. And while previous technology revolutions automated manual and routine work, and augmented labor or workers, the disruptive nature, and the enormous value-creating potential. This value comes in one of two forms.

Either it will replace or eliminate many jobs at all levels via skill commoditization or skill absorption, which can lead to enormous productivity improvements, or it will change jobs, requiring executives and employees at all levels to upskill or reskill and reimagine how work gets done. That leads to the question of how jobs will be either replaced or made redundant.

The answer is simple because AI makes use of our current hyperconnected world by analyzing it. AI is essentially a massive computer system that feeds of the available data, all those information contained in servers around the world, all those interactions on platforms and ecosystems, all those sensors that produce data, all those data hoarded in large main frame computers in companies. The data are the basis of machine learning which powers AI applications and the most powerful AI use cases. At Davos, one executive from L’Oreal was asked who will likely win in the AI future. The executive answered: L’Oreal will and in every industry the biggest companies will win. Why? Because these companies have the data that feeds the AI machines. L’Oreal can look back at many decades of beauty data, for example.

So, it is not surprising then why this new era, the AI era so quickly became a bubble. It did so because unlike the previous eras which took time because they were driven largely by consumer adoption of new technology, the AI revolutions is characterized by both executives and companies and consumer interest. Azeem Azhar summed it up in his newsletter: Gen AI has electrified bosses. In the previous eras, the C-suite had to be dragged into the web kicking and screaming.

The Vivaldi AI Model

Despite the characteristics and magnitude of the AI bubble, the essential inquiries revolve around the ways in which AI enhances a company’s competitive edge, facilitates the creation of new value, drives innovation, strengthens brands, and enables companies and brands to engage with consumers and customers, ultimately leading to a sustainable competitive advantage.

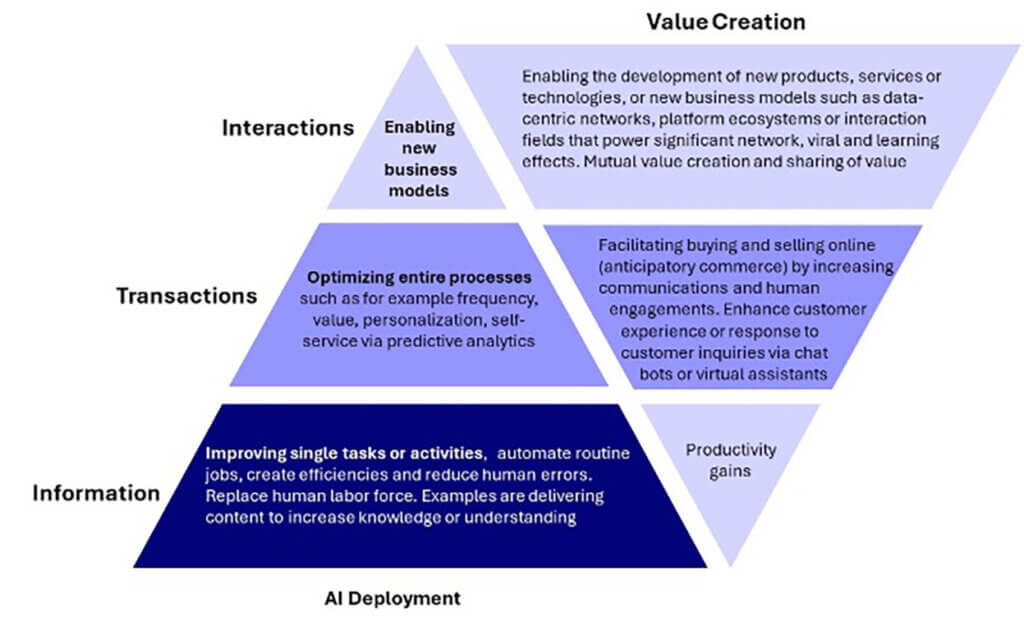

To address these questions, Vivaldi has developed the AI Value Model. This model is designed to investigate the role of AI in business, both in generating value for consumers and in capturing value for companies and brands.

The Vivaldi AI Deployment and Value Creation Model

Information leading to productivity improvements.

At the bottom of the model are AI applications that organize and process information to deliver productivity improvements. Studies show that the improvements can range from 20% to 45% depending on the industry, task and technology application. Many AI applications operate at this very level. Basic Gen AI usages are typical of these applications, they augment content and knowledge, for example when I use ChatGPT to summarize an article into a few paragraphs or when I want it to improve them without changing the meaning. I also can use an LLM to explain a topic so that I get a deeper understanding of a topic, or to automate processes that are repetitive, routine, or predictable tasks.

Wells Fargo illustrates the potential of AI by employing synthetic data to foster an autonomous innovation process.[4] The institution utilized synthetic users to expedite early-stage innovation, allowing for a deeper understanding of user behavior through the Jobs to Be Done (JTBD) framework. This innovative approach enabled Wells Fargo to carry out extensive interviews and qualitative survey analyses at scale, efficiently aggregate and prioritize data, and uncover insights into user behaviors in unique situations, such as changes following a natural disaster. The utilization of synthetic users, inherently confidential and operated on a secure, non-internet-connected on-premise Large Language Model (LLM), ensured that sensitive information remained within the confines of Wells Fargo, aligning with the financial industry’s risk-averse nature.

The effectiveness of synthetic users was demonstrated through an experiment comparing the survey responses of 8,000 synthetic users against 1,200 real users, divided into five persona groups. The findings revealed that four out of the five groups provided consistent answers, affirming the reliability of synthetic users in mirroring real user responses. These key learnings highlight that synthetic users not only significantly boost productivity by enabling rapid, large-scale testing and analysis of user behavior but also show great promise for the future of autonomous innovation within Wells Fargo. It also shows that integrated into the innovation workflow process, AI can act like a multi-talented assistant that increases efficiency, potentially reduces errors. While it does not replace the work in innovation, it definitely enhances it. At the least, it enables processing of large volumes of information and data quickly and efficiently.

Transaction leading to improvements of entire processes.

The subsequent level pertains to the automation or augmentation of transactions between a company and its customers. This can involve modifying or streamlining the process of buying or selling, engaging in e-commerce or direct-to-consumer strategies, or facilitating monetary transfers through a banking application.

L’Oréal’s Beauty Genius serves as an exemplary instance of this concept.[5] It revolutionizes the consumer experience of applying or managing skincare by offering personalized skincare and makeup recommendations. Essentially, Beauty Genius functions as an advanced or AI-enhanced chatbot. It evaluates users’ skin conditions and provides tailored advice.

Beauty Genius was developed through training on thousands of images and products, enabling it to offer precise skin analysis and highly customized product suggestions. Users initiate this process by uploading a photo of themselves, which is used to evaluate skin attributes, and by answering detailed questions regarding their skin condition and preferences. This process is highly interactive and engaging, laying the groundwork for accurate skin analysis and the proposal of personalized skincare routines that align with the users’ needs.

Furthermore, L’Oréal’s application underscores several key factors for success. AI is integrated in a manner that appears seamless, enhancing users’ daily skincare management without automating or eliminating the user experience. It augments rather than replaces, ensuring users maintain control while benefiting from the synergy of AI and L’Oréal’s expertise in beauty.

This approach not only enhances the user experience but also offers L’Oréal advantages such as more targeted product sales, which may increase customer satisfaction and loyalty.

Interactions to power new business models.

This highest level involves reciprocal communications or data flows between individuals or between individuals and companies. There are much fewer applications of AI at this level today. An example is Amie, a conversational medical AI that is designed to assist in the diagnosis within a doctor-patient relationship.[6] The system helps doctors in the diagnoses, improving its quality, and enabling more diagnoses than are possible today. A doctor for example can see only 10,000 patients in a career, while Amie can potentially “see that many” patients in just a couple of training cycles. Amie stands for Articulate Medical Intelligence Explorer, and while it is still purely experimental, it points toward the real potential of AI in creating significant value for everybody.

Researchers at Google developed this AI by feeding it with real-world medical texts, including transcripts of nearly 100,000 real physician-patient dialogues, 65 clinical-written summaries of intensive care unit medical notes, and thousands of medical reasoning questions taken from the United States Medical Licensing Examination. In tests of Amie against real doctors, Aime provided greater diagnostic accuracy and superior performance. Interesting is that the measure of performance included such soft factors as perceived empathy, openness and honesty. Amie performed better than the human counterparts.

The value of an AI like Amie can be transformative when considering its expansion possibilities. For example, by seamlessly integrating with EHR systems, Amie could access patient histories, lab results and other relevant data, and even further improve its diagnostic accuracy and personal recommendations based on a patients’ medical history.

It could include features aimed at increasing patient engagement and education. Amie could expand into continuous patient monitoring through wearable devise and mobile health apps, providing real-time data to healthcare providers and alerting them to potential health issues before they become serious. Features could be personal health tips, medication reminders, and other interactive tools. Data could be aggregated and analyzed from across millions of patients and identify trends, improve healthcare outcomes, and contribute to medical research, leading potentially to new treatments and deeper understanding of various health conditions.

Ultimately, an entire health interaction field could be built on top of these interactions, connecting patients with a variety of health services, such as specialist healthcare providers and doctors provided by institutions or care centers regardless of location, pharmacies for medication delivery, labs for diagnostic tests, and wellness programs.[7]

In short, the potential would be to create significant network effects, viral effects and learning effects, by integrating Amie with a wider range of health services, and providing more comprehensive support for both healthcare providers and patients. This can become a wholesale transformation of how healthcare services can be delivered either in-person or through telehealth services. It offers the promise of more personalized, efficient and accessible care, anywhere around the world.

[1] One of us has discussed these eras in the book: The Interaction Field: The Revolutionary New Way to Create Shared Value for Businesses, Customers and Society, Public Affairs, 2020, p. 17. See also: Cory Doctorow, “What Kind of Bubble,” Medium, Dec 19, 2023.

[2] Evidence of the concentrated market power of Apple, Alphabet, Amazon, Meta and Microsoft comes from their financials. In 2023, the group together made over $1.6 trillion in revenues, and earned over $327 billion in profits.

[3] James Manyika and Michael Spence (2023), “The Coming AI Economic Revolution,” Foreign Affairs, November – December.

[4] Adam Holt (2023), “Innovating with Purpose: Unleashing the Power of Jobs-to-Be-Done and Outcomes-based Innovation,” December 7, Autonomous Innovation Summit.

[5]. https://www.campaignlive.com/article/loreal-showcases-ai-powered-advisor-beauty-genius-ces/1856937

[6] https://blog.research.google/2024/01/amie-research-ai-system-for-diagnostic_12.html?m=1

[7] See: Joachimsthaler, Erich (2020), The Interaction Field: The Revolutionary New Way to Create Shared Value for Businesses, Customers and Society, Public Affairs.